Navigating the mortgage landscape can be challenging, especially when traditional banks have strict lending criteria.

Private mortgage lenders offer an alternative that comes with several advantages.

In this article, we’ll explore the key benefits of choosing private mortgage lenders and how they can be a great option for many borrowers.

Flexibility in Lending Criteria

One of the biggest benefits of private mortgage lenders is their flexible lending criteria.

Unlike traditional banks that adhere strictly to credit scores and income levels, private lenders are more willing to look at the bigger picture.

They consider the overall potential of the borrower and the property, making it easier for more people to qualify for a mortgage.

Examples of Flexible Lending

Private lenders are often willing to work with:

- Self-employed individuals with irregular income

- Borrowers with less-than-perfect credit scores

- Investors looking to finance unconventional properties

- Clients needing short-term bridge loans

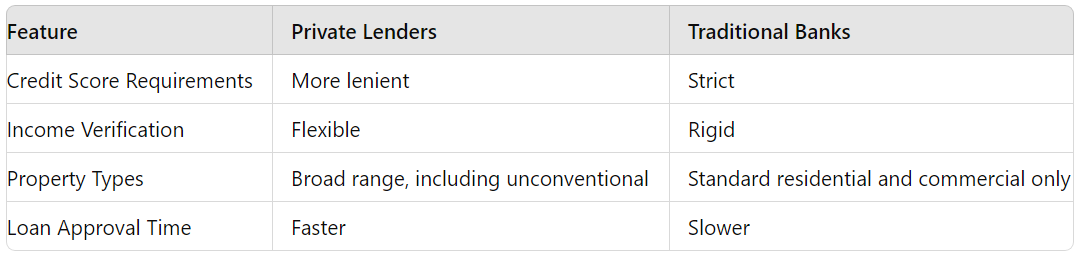

Comparison of Private Lenders and Traditional Banks

We offer tailored plans to fit your financial goals. For more details, check out our Mortgage Solutions.

Faster Approval Process

Another significant benefit of private mortgage lenders is the speed of their approval process.

Traditional banks often have lengthy and complex approval procedures, which can be frustrating and time-consuming for borrowers.

In contrast, private lenders streamline their processes, enabling quicker decisions and faster access to funds.

Advantages of Fast Approvals

Quick approvals are particularly beneficial in situations where time is of the essence. For example:

- Real Estate Investments: Investors looking to capitalize on a hot market need funds quickly to secure properties.

- Emergency Repairs: Homeowners needing urgent repairs can get the necessary funds without delay.

- Bridge Loans: Borrowers who need short-term financing to bridge the gap between buying a new property and selling an old one can benefit from the swift approval.

Customized Loan Solutions

Private mortgage lenders excel at offering customized loan solutions that meet the unique needs of each borrower.

Unlike traditional banks that have rigid loan structures, private lenders can tailor their loans to suit specific financial situations and property types.

Tailored Loan Scenarios

Here are some examples of how private lenders can customize loans:

- Self-Employed Borrowers: Private lenders can structure loans to accommodate irregular income streams, making it easier for self-employed individuals to secure financing.

- Investors: They can offer tailored loans for investment properties, including fix-and-flip projects and rental properties.

- Unique Properties: For borrowers looking to finance unconventional properties like vacation homes or multi-use buildings, private lenders can create customized loan packages.

- Short-Term Needs: Whether you need a short-term bridge loan or financing for a quick renovation project, private lenders can adjust terms and repayment schedules to fit your timeline.

For more information on customized mortgage solutions, check out our Customized Mortgage Solutions.

Competitive Interest Rates

While many assume that private lenders charge higher interest rates than traditional banks, this isn’t always the case.

Private Mortgage experts can often offer competitive rates, especially when they see potential in a borrower’s unique circumstances or property.

Situations with Competitive Rates

Here are a few scenarios where private lenders might offer better rates:

- High-Value Properties: For properties that are considered high-value or in desirable locations, private lenders might offer lower rates to secure the deal.

- Strong Collateral: Borrowers with strong collateral can negotiate better rates with private lenders.

- Short-Term Loans: For short-term loans, private lenders can often offer rates that are comparable or even better than traditional banks.

- Customized Risk Assessments: Private lenders assess risk differently than traditional banks, allowing for more personalized rate offers.

Opportunities for Those with Poor Credit

One of the standout benefits of private mortgage lenders is their willingness to work with borrowers who have poor credit.

Traditional banks often have strict credit score requirements, making it difficult for those with blemished credit histories to secure a mortgage.

Private lenders, however, are more flexible and consider the overall potential of the borrower and the property.

Benefits for Borrowers with Poor Credit

Flexible Criteria: Private lenders evaluate the full financial picture rather than just the credit score, giving more borrowers a chance to qualify.

Rebuilding Credit: Securing a loan from a private lender can help borrowers rebuild their credit by demonstrating responsible repayment behavior.

Access to Financing: For those who might otherwise be shut out of the mortgage market, private lenders provide essential access to financing that can be crucial for personal and financial growth.

Conclusion

Choosing a private Mortgage specialist offers numerous benefits, including flexible lending criteria, faster approvals, customized loan solutions, competitive interest rates, and opportunities for those with poor credit.

These advantages make private lenders a viable option for many borrowers who might struggle to meet the stringent requirements of traditional banks.

We are dedicated to helping you find the best financing solutions tailored to your unique needs. Whether you have perfect credit or are looking to rebuild, our team is here to guide you through the process and secure the financing you need.