The recent imposition of US tariffs on Canadian imports has raised concerns about its impact on various sectors, particularly the housing market and consumer spending.

With tariffs on lumber, steel, aluminum, and other essential construction materials reaching up to 25%, the cost of building homes in Canada is expected to rise significantly.

For homebuyers, this could mean higher property prices, while developers may struggle with increased costs, leading to potential delays in new housing projects.

At the same time, these trade policies may also affect home renovations, as materials like glass, appliances, and hardware become more expensive.

Beyond real estate, consumer spending habits could shift due to rising costs, creating broader economic challenges.

This article explores how US-Canada tariffs are shaping the Canadian housing market, what they mean for buyers and investors, and how businesses and policymakers are responding to these changes.

Understanding US-Canada Tariffs

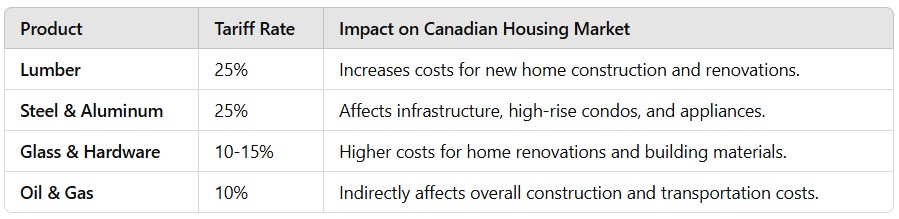

Trade tariffs are taxes imposed on imported goods, making them more expensive for buyers in the importing country.

The United States has recently increased tariffs on Canadian goods, affecting materials critical to home construction, such as lumber, steel, and aluminum.

These tariffs are part of broader trade policies aimed at protecting American industries but have significant consequences for Canada’s economy.

What Are the Key Tariffs?

Why Are These Tariffs Being Imposed?

- Economic Protectionism: The U.S. aims to reduce reliance on foreign materials.

- Trade Disputes: Ongoing disagreements over pricing and trade fairness.

- Supply Chain Adjustments: The U.S. is reshaping its sourcing strategies, affecting Canadian exports.

How Does This Affect Canada?

- Developers face higher material costs, leading to increased home prices.

- Renovation projects become more expensive due to higher-priced building materials.

- Potential job losses in construction-related industries as projects get delayed or canceled.

As these tariffs take effect, the impact on Canada’s housing sector is expected to intensify, influencing everything from new home construction to homebuyer affordability.

Rising Construction Costs and Housing Affordability

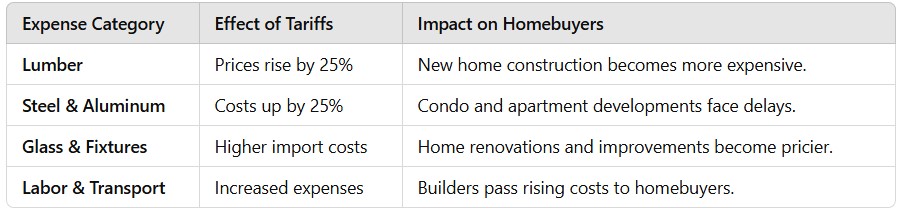

One of the most immediate effects of US tariffs on Canadian goods is the sharp increase in construction costs.

Since materials like lumber, steel, and aluminum are heavily used in homebuilding, developers are facing higher expenses, which will inevitably be passed down to homebuyers and renters.

How Tariffs Are Driving Up Home Prices

The rising costs of materials due to tariffs have created a new layer of financial pressure on an already expensive housing market.

New home prices are increasing as builders adjust to higher raw material costs.

Affordable housing projects are at risk due to budget constraints.

Higher mortgage costs combined with rising home prices make homeownership more difficult.

Breakdown of Construction Cost Increases

Builders Are Reducing New Construction

Developers are already struggling with labor shortages and rising interest rates, and these new tariffs further complicate housing supply.

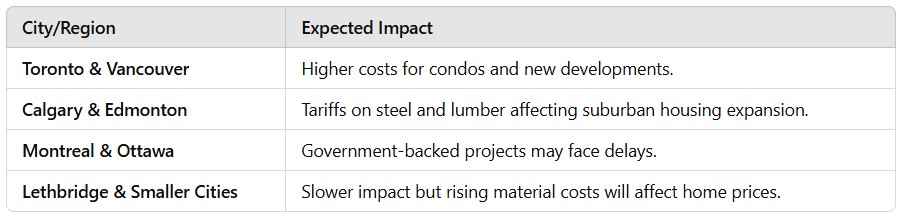

Some projects may be delayed or canceled, worsening Canada’s housing inventory crisis—especially in cities like Toronto, Vancouver, and Calgary where demand already outpaces supply.

Who Gets Affected the Most?

- First-time homebuyers: Higher home prices reduce affordability.

- Renters: Fewer new apartments mean rising rent prices.

- Homeowners planning renovations: Material costs are increasing across the board.

The combined effect of higher costs, fewer new builds, and increased demand will continue to push home prices higher, making affordability a growing concern.

Slowdown in Housing Construction & Market Uncertainty

The Canadian housing market is already struggling with low inventory and rising demand, and these new tariffs are adding even more pressure.

With the cost of materials increasing, builders and developers are scaling back projects, leading to a slowdown in new home construction.

This has long-term implications for affordability, availability, and overall market stability.

How Tariffs Are Slowing Down Construction

- Developers delay or cancel projects due to unpredictable costs.

- Fewer new homes entering the market, worsening the existing housing shortage.

- Higher construction costs make affordable housing projects unfeasible.

Impact on Major Canadian Cities

Some regions will feel the effects of tariffs more than others.

Why Homebuilders Are Hesitant

Many construction companies are now reevaluating their investments before moving forward with new developments. They are:

- Waiting for potential tariff reductions before committing to long-term projects.

- Relying on alternative materials that may not always meet quality standards.

- Increasing pre-construction home prices to offset anticipated expenses.

How This Affects Buyers & Renters

- Buying a new home will become more expensive as developers pass rising costs to consumers.

- Fewer new rental units will be built, leading to higher rent prices.

- Uncertainty in the market may push some buyers to hold off on purchasing.

With the housing supply tightening and costs rising, affordability concerns will continue to grow.

The Canadian government may need to introduce new policies to counteract these trade pressures and keep housing within reach for Canadians.

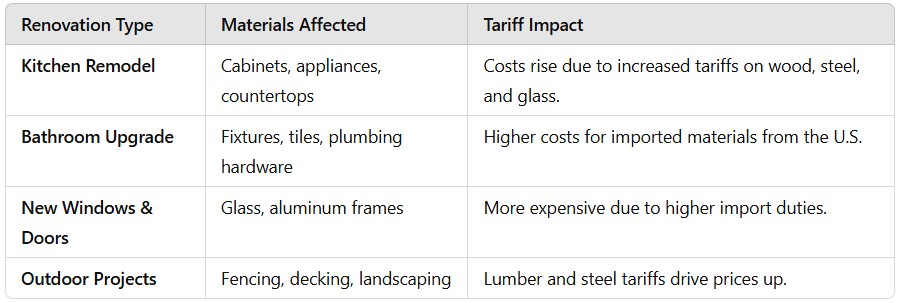

Impact on Home Renovations and Consumer Spending

The effects of US tariffs are not limited to new home construction—they are also driving up home renovation costs and influencing consumer spending habits. With higher import duties on essential building materials, Canadians looking to upgrade their homes will face increased expenses.

Why Home Renovation Costs Are Rising

Many renovation projects rely on imported materials such as lumber, glass, steel, and appliances, which are now subject to higher tariffs. This leads to:

Increased costs for home improvement projects like kitchen upgrades, bathroom remodels, and flooring replacements.

Rising prices for essential materials such as drywall, cabinets, and hardware.

Delays in renovations as contractors and suppliers deal with higher material costs and supply chain issues.

Breakdown of Higher Costs for Homeowners

Consumer Spending Takes a Hit

Higher prices on goods and services due to tariffs are likely to impact household budgets, leading to shifts in spending habits:

More Canadians may delay renovations or opt for smaller-scale projects.

Furniture, appliances, and home decor prices will rise, making home improvements more costly.

Discretionary spending on travel, entertainment, and luxury items may decrease as households adjust their budgets.

The Ripple Effect on the Economy

With higher costs across the board, businesses in retail, home improvement, and construction may see a slowdown in demand.

Contractors could struggle with fewer projects, and supply chain disruptions may make materials harder to source.

Who Benefits from These Changes?

Homeowners who already own property may see an increase in their home’s value due to rising new-build prices.

Landlords may benefit from higher rental demand as fewer people can afford to buy.

Investors in materials manufacturing may see opportunities in domestic production.

Overall, tariffs on home improvement materials will tighten consumer budgets and create additional financial stress for homeowners looking to renovate.

Higher renovation costs mean homeowners will need to budget carefully before upgrading their properties.

Government Response & Policy Measures

As the impact of US tariffs on Canadian housing and consumer spending grows, the Canadian government is introducing measures to protect the economy and support businesses. These policies aim to stabilize housing costs, support affected industries, and ease financial strain on homeowners and buyers.

1. Tariff Relief & Financial Assistance

To help offset rising costs in the construction sector, the government is considering:

Temporary tariff relief programs for essential materials like lumber, steel, and aluminum.

Financial aid for developers and homebuilders to keep housing projects on track.

Incentives for domestic material production to reduce reliance on imports.

2. Support for Homebuyers and Renters

With affordability becoming a growing concern, policymakers are looking at ways to ease the burden on Canadians looking to buy or rent homes:

First-time homebuyer incentives may be expanded to help offset rising costs.

Rental assistance programs could be introduced in high-demand urban areas.

Government-backed low-interest financing for renovations and home improvements.

3. Trade Negotiations & Diplomatic Efforts

The Canadian government is engaging in discussions with U.S. officials to:

Advocate for the reduction or removal of housing-related tariffs.

Seek exemptions for critical building materials to stabilize construction costs.

Strengthen trade agreements with other countries to diversify supply chains and reduce dependency on U.S. imports.

4. Encouraging Domestic Manufacturing & Supply Chain Diversification

To reduce reliance on U.S. imports, Canada is focusing on:

Expanding domestic steel, aluminum, and lumber production to create a more self-sufficient construction industry.

Strengthening trade relationships with Europe, Asia, and Latin America to secure alternative sources for building materials.

Promoting Canadian-made home appliances, fixtures, and construction goods to mitigate rising costs.

What This Means for Homebuyers & Businesses

If relief measures are successful, we could see a slowdown in home price increases.

Builders may receive financial aid, to keep construction projects moving.

Consumers may get more government-backed options to afford homes and renovations.

While tariffs have already started affecting housing costs, these government initiatives aim to ease financial strain and prevent further affordability challenges. However, the success of these policies depends on ongoing trade negotiations and market conditions.

Policy decisions in the coming months will shape the future of Canada’s housing market and economy.

How Homebuyers & Investors Can Adapt

As tariffs continue to impact housing costs, homebuyers, investors, and homeowners must adjust their strategies to navigate rising prices and market uncertainties.

Whether you’re planning to buy, invest, or renovate, understanding how to adapt to these changes will be crucial.

1. Homebuyers: Acting Before Prices Rise Further

For those looking to purchase a home, waiting too long could mean paying even higher prices due to increasing construction costs.

✅ Consider Buying Sooner – With material costs rising, delaying a purchase could result in a higher-priced home in the future.

✅ Explore Government Incentives – Take advantage of first-time homebuyer programs and low-interest financing options to offset higher costs.

✅ Expand Your Search Area – Look beyond major cities like Toronto and Vancouver, where prices are soaring, and consider growing markets in secondary cities.

👉 Lock in your mortgage rate before prices climb further! Get expert advice today.

2. Real Estate Investors: Shifting Strategies

With new construction becoming more expensive, real estate investors may need to adjust their approach to stay profitable.

✅ Focus on Resale Properties – Instead of investing in new builds, consider existing homes with lower material costs and more predictable pricing.

✅ Increase Rental Portfolio – With fewer people able to afford homes, rental demand is rising, making multi-family properties a strong investment choice.

✅ Renovate Wisely – Avoid high-cost renovations that rely on tariff-affected materials, and instead look for cost-efficient upgrades.

3. Homeowners: Making Smart Renovation Decisions

For homeowners looking to upgrade their properties, the increased cost of materials means that renovation budgeting is more important than ever.

✅ Prioritize Essential Upgrades – Focus on critical renovations (roof, insulation, energy-efficient features) rather than luxury add-ons.

✅ Compare Local vs. Imported Materials – Consider using Canadian-made products instead of tariffed imports to lower costs.

✅ Lock in Contractor Pricing Early – As material costs fluctuate, securing a renovation contract before further price hikes can save thousands.

4. Alternative Financing for Housing & Investments

With prices rising, homebuyers and investors should explore creative financing solutions to navigate affordability challenges.

✅ Look for Alternative Mortgage Options – Consider variable-rate mortgages if rates are expected to drop further.

✅ Use Home Equity for Investments – Leverage home equity lines of credit (HELOCs) to invest in properties before prices rise further.

✅ Partner with Other Investors – Pooling funds with like-minded investors can help manage higher property costs in expensive markets.

Taking Action in a Changing Market

While tariffs are driving up home prices, there are still strategies to stay ahead.

Whether buying, investing, or renovating, adjusting to the changing landscape will help maximize opportunities while minimizing financial strain.

Smart decision-making now can help homebuyers and investors thrive despite rising costs.

Conclusion

The impact of US tariffs on Canada’s housing market and consumer spending is already being felt, with rising construction costs, higher home prices, and increased pressure on affordability.

As tariffs on lumber, steel, aluminum, and other building materials drive up expenses, both homebuyers and developers face new financial challenges.

For those looking to purchase or invest in real estate, adapting to these changes is crucial.

While home prices and rental demand are expected to increase, strategic planning—such as exploring alternative financing, adjusting investment strategies, or acting before further price hikes—can help navigate this shifting landscape.

The Canadian government’s response through tariff relief, policy incentives, and supply chain adjustments may provide some relief, but long-term solutions depend on trade negotiations and market adaptation.

Whether you’re a homebuyer, investor, or industry professional, staying informed and proactive is the best way to make smart financial decisions in a rapidly evolving market.

Despite the challenges, opportunities still exist for those who plan ahead and stay flexible in their approach.