Understanding the difference between open and closed mortgage options is essential to making the right decision for your financial future when choosing a mortgage.

These two mortgage types offer distinct features, and the best choice often depends on your priorities, whether it’s flexibility or lower costs.

An open mortgage allows you to make extra payments or pay off the loan entirely without penalties, making it ideal for those who value financial freedom.

In contrast, a closed mortgage comes with lower interest rates but limited flexibility for early payments.

This article breaks down the key differences, pros and cons, and practical tips to help you decide which option aligns with your goals.

What is an Open Mortgage?

An open mortgage is a loan that offers maximum flexibility for borrowers who may want to pay off their mortgage ahead of schedule.

With this option, you can make extra payments or even pay off the entire loan at any time without facing prepayment penalties.

This makes it a great choice for those who anticipate receiving a financial windfall, such as a bonus, inheritance, or proceeds from selling another property.

Key Features of an Open Mortgage

No Prepayment Penalties: Borrowers can make additional payments or pay off the balance entirely without fees.

Higher Interest Rates: In exchange for flexibility, open mortgages often come with slightly higher interest rates than closed mortgages.

Shorter Terms: Open mortgages are typically offered for shorter terms, such as 6 months to 1 year, making them suitable for short-term needs.

Get flexible payment options. Talk to us about open mortgages today.

What is a Closed Mortgage?

A closed mortgage is a loan with more structured terms, offering lower interest rates in exchange for limited flexibility.

Unlike an open mortgage, closed mortgages impose penalties if you decide to make additional payments beyond the agreed-upon limits or pay off the loan early.

This option is ideal for borrowers looking for predictable, long-term payment plans and lower overall borrowing costs.

Key Features of a Closed Mortgage

Lower Interest Rates: Closed mortgages typically have lower rates compared to open mortgages, making them more cost-effective for long-term borrowers.

Prepayment Restrictions: Payments beyond the prepayment allowance often result in penalties, which can vary by lender.

Longer Terms: Closed mortgages are available in longer terms, such as 3, 5, or even 10 years, providing stability and predictability.

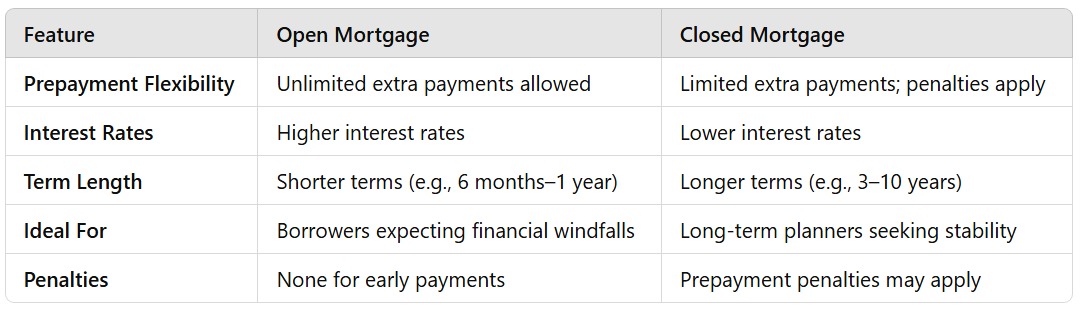

Key Differences Between Open and Closed Mortgages

When deciding between an open and closed mortgage, it’s important to understand how they differ in terms of flexibility, cost, and suitability for different financial situations.

Here’s a breakdown of the key distinctions:

Pros and Cons of Open Mortgages

An open mortgage provides significant flexibility but comes with trade-offs. Understanding the advantages and disadvantages can help you decide if it aligns with your financial goals.

Pros of Open Mortgages

Prepayment Freedom: You can make unlimited extra payments or pay off the loan early without penalties.

Short-Term Solution: Ideal for borrowers with short-term needs, such as those expecting a financial windfall or planning to sell their property.

Adaptability: Allows you to adjust your payment schedule as your financial situation changes.

Cons of Open Mortgages

Higher Interest Rates: Flexibility comes at a cost, with higher rates compared to closed mortgages.

Not Ideal for Long-Term Borrowing: The higher rates make it less suitable for those planning to hold the mortgage for several years.

Shorter Terms: Typically limited to shorter terms, which may require renewal sooner than a closed mortgage.

Pros and Cons of Closed Mortgages

A closed mortgage is one of the most common options for homeowners due to its lower interest rates and structured payment terms. However, it comes with restrictions that may not suit everyone.

Pros of Closed Mortgages

Lower Interest Rates: Closed mortgages typically have lower rates, making them cost-effective for long-term borrowers.

Predictable Payments: Fixed payment schedules provide stability and make budgeting easier.

Longer Terms: With term options ranging from 3 to 10 years, closed mortgages offer the security of locked-in rates.

Cons of Closed Mortgages

Prepayment Penalties: Making payments beyond the allowable limit or paying off the mortgage early often incurs penalties.

Less Flexibility: Borrowers have limited options to adjust their payment plans without incurring fees.

Commitment to Terms: Breaking the mortgage before the term ends can be costly, making this less ideal for those with changing financial situations.

Unsure which mortgage suits you? Reach out for expert advice

Which Mortgage is Right for You?

Choosing between an open and closed mortgage depends on your financial goals, plans, and the level of flexibility you need. By weighing the features of each, you can determine which option suits your situation best. Key Considerations:

Financial Flexibility

- If you expect to make extra payments or pay off your loan early, an open mortgage provides the freedom to do so without penalties.

- If you’re comfortable with fixed payments and don’t anticipate major financial changes, a closed mortgage is more cost-effective.

Loan Duration

- For short-term needs, such as bridging a financial gap or transitioning between properties, open mortgages are ideal.

- For long-term stability, closed mortgages offer predictable payments and lower interest rates.

Cost Savings

- If minimizing interest is your primary concern, closed mortgages are the better choice.

- If avoiding penalties is more important, an open mortgage is the way to go.