Staying informed about mortgage rate trends is crucial for homeowners and potential buyers alike.

As we move into 2024, understanding these trends can help you make better financial decisions, whether you are looking to buy a home, refinance an existing mortgage, or plan for future investments.

We provide expert insights into the financial landscape to help you navigate these changes with confidence.

In this article, we will explore the latest trends in Canadian mortgage rates for 2024, the factors influencing these rates, and tips on securing the best rates.

Overview of the Current Mortgage Rate Landscape

As of the beginning of 2024, Canadian mortgage rates have shown significant fluctuations influenced by various economic and market conditions.

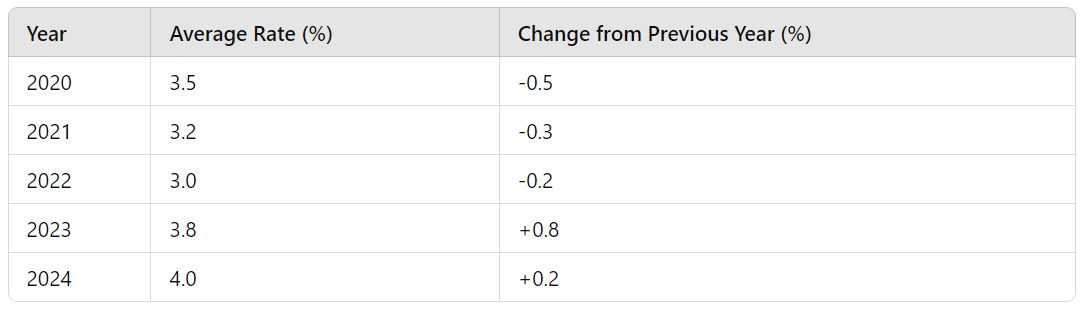

The following table outlines the historical mortgage rates over the past few years, highlighting the changes and trends:

Recent Changes and Their Impacts

In recent years, mortgage rates in Canada have been influenced by various factors, including economic recovery post-pandemic, inflation rates, and monetary policies set by the Bank of Canada.

The slight increase in rates observed at the end of 2023 and the beginning of 2024 reflects the central bank’s efforts to control inflation and stabilize the economy.

This increase impacts both new homebuyers and existing homeowners, particularly those with variable-rate mortgages.

Get Expert Mortgage Advice | Free Resources at Team Money

Factors Influencing Mortgage Rates

Understanding the factors that influence mortgage rates can help you anticipate changes and make informed decisions. Several key factors are at play when determining mortgage rates in Canada:

Economic Indicators

Economic indicators such as inflation, employment rates, and GDP growth significantly impact mortgage rates.

When the economy is strong, with rising employment and GDP, the demand for credit increases, often leading to higher interest rates.

Conversely, during economic downturns, rates tend to decrease to encourage borrowing and stimulate the economy.

Government Policies

The Bank of Canada plays a pivotal role in setting monetary policies that affect mortgage rates.

By adjusting the overnight rate, the central bank can influence the cost of borrowing. For instance, to curb inflation, the Bank of Canada might increase interest rates, which, in turn, raises mortgage rates.

Government policies on housing and financial regulations also impact these rates.

Market Demand

Market demand for housing and mortgages can drive rates up or down. High demand for homes typically leads to higher mortgage rates as lenders capitalize on the increased market activity. Conversely, when demand is low, lenders may lower rates to attract more borrowers.

- Infographic: Factors Influencing Mortgage Rates

- Economic Indicators: Inflation, Employment Rates, GDP Growth

- Government Policies: Monetary Policies, Housing Regulations

- Market Demand: Housing Market Activity, Borrower Demand

Unlock the Best Mortgage Rates with Team Money

Expert Predictions for Mortgage Rates in 2024

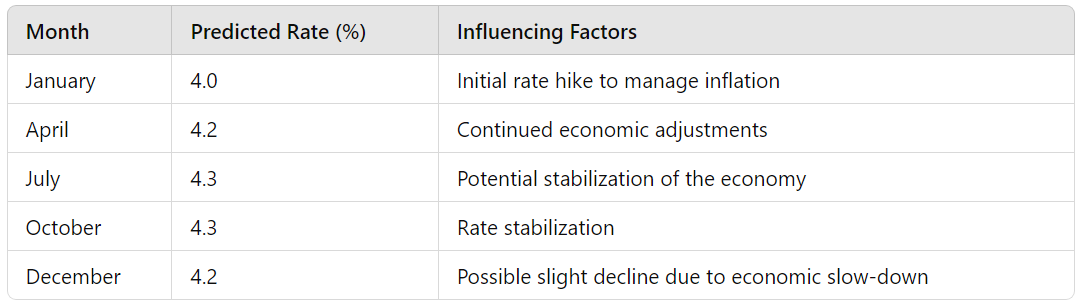

As we look ahead into 2024, experts have varying predictions about the trajectory of mortgage rates in Canada. Several economic analysts and financial institutions have provided their insights based on current economic trends and market conditions.

Modest Increases: Many experts predict a modest increase in mortgage rates throughout 2024. This is largely due to the Bank of Canada’s continued efforts to manage inflation and stabilize the economy. Incremental rate hikes are expected, aiming to keep inflation within the target range.

Stabilization: Some analysts believe that after an initial increase in the first half of the year, mortgage rates may stabilize as the economy finds a balance between growth and inflation control. This stabilization will provide a more predictable environment for both lenders and borrowers.

Potential Declines: There is also a scenario where mortgage rates could see slight declines if the economy slows down more than expected, prompting the Bank of Canada to adjust its monetary policy to encourage borrowing and spending.

Predicted Mortgage Rate Trends for 2024

Effects on Current Homeowners

The changing mortgage rates in 2024 will have various impacts on current homeowners, particularly those with variable-rate mortgages. Here’s how they might be affected:

Monthly Payments: For homeowners with variable-rate mortgages, an increase in mortgage rates will lead to higher monthly payments. This can strain household budgets and requires careful financial planning.

Refinancing Decisions: Homeowners may consider refinancing their mortgages to lock in fixed rates before further increases occur. Refinancing can provide stability in monthly payments and protect against future rate hikes.

Home Equity: Rising interest rates can slow down the housing market, potentially affecting home values. Homeowners might see slower equity growth compared to periods of lower rates.

Considerations for Potential Buyers

For potential homebuyers, understanding mortgage rate trends is crucial for making informed purchasing decisions. Here are some key considerations:

Affordability: Higher mortgage rates can affect affordability, as increased interest costs reduce the amount of loan one can qualify for. Buyers need to budget carefully and consider the long-term costs of higher rates.

Timing the Market: Some buyers may choose to enter the market sooner rather than later to secure current rates before predicted increases take effect. However, it’s important to balance this urgency with thorough financial preparedness.

Fixed vs. Variable Rates: Deciding between fixed and variable rates becomes even more critical in a fluctuating rate environment. Fixed rates offer stability, while variable rates might offer savings if rates decline in the future.

Find Your Dream Home Affordably | Get a Mortgage Quote from Us

Strategies for Homeowners and Buyers

Securing favorable mortgage rates can significantly impact your financial health. Here are some strategies to help both homeowners and potential buyers get the best rates possible:

- Improve Your Credit Score: A higher credit score often qualifies you for lower interest rates. Make timely payments, reduce outstanding debt, and correct any errors on your credit report.

- Save for a Larger Down Payment: A larger down payment reduces the loan amount and may qualify you for better rates. Aim for at least 20% of the property’s value.

- Shop Around: Don’t settle for the first mortgage offer you receive. Compare rates from different lenders to find the most competitive terms.

- Consider Rate Lock Options: If you anticipate that rates will rise, consider locking in your rate when you apply for your mortgage. This can protect you from future rate increases.

- Work with a Mortgage Broker: Brokers have access to multiple lenders and can help you find the best deals based on your financial situation.

Frequently Asked Questions (FAQs)

Q. What are the essential factors influencing mortgage rates?

Ans: Essential factors influencing mortgage rates include economic indicators (such as inflation and employment rates), government policies (set by the Bank of Canada), and market demand for housing. These factors collectively determine the cost of borrowing and influence the overall mortgage rate landscape.

Q. How can homeowners manage rising mortgage rates?

Ans: Homeowners can manage rising mortgage rates by refinancing their variable-rate mortgages to fixed rates, thereby stabilizing their monthly payments. Additionally, maintaining a good credit score and saving for larger payments can help in securing better terms.

Q. What should potential buyers consider when mortgage rates are high?

Ans: Potential buyers should consider their overall affordability and budget carefully when mortgage rates are high. They may need to adjust their home price range or save for a larger down payment. It’s also crucial to weigh the benefits of fixed vs. variable rates based on personal financial stability and market predictions.

Q. How does the Bank of Canada influence mortgage rates?

Ans: The Bank of Canada influences mortgage rates through its monetary policy, primarily by adjusting the overnight rate. Changes in this rate affect the interest rates that banks charge on loans, including mortgages. By raising or lowering the overnight rate, the Bank of Canada can influence borrowing costs and economic activity.